Oscar Pistorius Net Worth: The Blade Runner

Oscar Pistorius, also known as the Blade Runner, is a former South African sprint runner and convicted murderer. He was born on November 22, 1986, […]

Oscar Pistorius, also known as the Blade Runner, is a former South African sprint runner and convicted murderer. He was born on November 22, 1986, […]

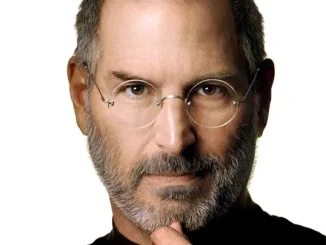

Steve Jobs (February 24, 1955-October 5, 2011) was one of the most influential figures in the tech industry, co-founding Apple Inc., and changing the way […]

Sandile Zungu is a well-known South African businessman, entrepreneur, philanthropist, and football club owner who has established himself in the commercial sector over time. He […]

Jim Parsons is an American actor and producer best known for his portrayal of Sheldon Cooper on the successful CBS sitcom “The Big Bang Theory”. […]

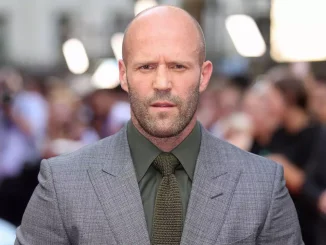

Jason Statham, the British actor known for his intense action roles, has carved a niche for himself in the entertainment industry. From his early days […]

Lady Gaga is among the most popular and influential music stars of our time. She has won the hearts of millions of admirers around the […]

Mthokozisi Yende is a Former South African football player who made a name for himself in the Premier Soccer League (PSL). He is currently a […]

Pearl Thusi was born Sithembile Xola Pearl Thusi on May 13, 1988, in KwaZulu-Natal, South Africa. Pearl has become a household name in the entertainment […]

Jason Noah is a young and successful forex trader hailing from South Africa. His journey from humble beginnings to becoming a self-made millionaire is both […]

Meghan Markle is a name that has been making headlines since she married Prince Harry in May 2018. However, before she became the Duchess of […]

Copyright © 2024 | Crafted by FakazaHub Team